November 11 is known as Remembrance Day in the USA, Canada and other allied nations and a day to honor and remember the soldiers who died during their service to their country, starting from World War I. But Armenians and other minorities in Turkey remember November 11 as the day of legalized robbery and forced bankruptcy by the Turkish government during World War II.

The Wealth Tax legislation was passed on November 11, 1942, imposing arbitrary, unbearable taxes on Armenians, Greeks and Jews living in Turkey, not based on their income, but on their known or ‘imagined’ assets. The result was economic destruction of the remaining minorities in Turkey and complete transfer of wealth, production and economic activity from the minorities to the Turks, effectively ‘nationalization of the economy.’ This article provides a summary of the events surrounding the legislation, making use of memoirs of some Armenian families who suffered the consequences, as well as articles written by Turkish sources such as investigative author and historian Sait Cetinoglu and Istanbul Tax Office accountant at the time, one of the implementers of the legislation, Faik Okte.

The justification for the wealth tax was to prevent profiteering and black-market riches created during the war conditions. For a few months before the legislation, the Turkish media continuously published articles of wealthy minority opportunists and caricatures of ‘black market Jews’. But the government saw this situation as an opportunity to ‘eliminate’ minorities from the economy. The Prime Minister Sukru Saracoglu explained the government policy in a speech in August 1942: ‘We are Turks and Turkists forever. We do not wish for the dominance of any palace, class or capital. We just want to ensure the dominance of the Turkish nation.’ The legislation proposed to tax people based on their ethnic identity and religion. People were labeled Muslim, Non-Muslim and Converted (Donme). Donme people were Jews, mostly from Thessaloniki, who had converted to Muslim Turks. The non-Muslims were further classified as Armenian, Greek and Jewish and taxed according to their ethnicity. Armenians were taxed the most, at 232 percent of their assessed wealth, Jews at 179 percent, Greeks at 156 percent and Muslim Turks only at 4.94 percent. Faik Okte writes that some Turks rejoiced, thanked God and sacrificed animals upon hearing the low tax percentage for them, which also meant that they would be able to buy the assets of the non-Muslims at auctions at ridiculously low prices.

On November 11, 1942, Parliament passed the wealth tax legislation without any debate. It proposed to establish tax assessment commissions, members of which were all Turks, mostly businessmen and merchants competing with Armenians, Jews and Greeks, obviously to benefit the most from the bankruptcy of the minorities. There could be no objection or appeal to the assessed tax, with a deadline of 15 days to pay the assessed tax in cash. At the end of 15 days, the remaining assets of the persons incapable of paying the assessed tax would be auctioned off for non-payment, and the person would be sent to labor camps in eastern Turkey in order ‘to pay his debt by physically working.’ These labor camps were established for road, railroad and tunnel construction projects, by breaking stones from rocky mountains under deplorable working and living conditions, sleeping in tents in freezing weather with minimal food and water.

The tax assessment commissions finished their work by December 1942. About 87 percent of the assessed taxes were for non-Muslims, seven percent for Muslim Turks and the remaining six percent for non-citizen foreigners. There are anecdotes of tax assessment commission members deciding the fate of Armenian and Greeks by throwing ‘heads or tails’ coins, to insert how many zeros on their assets and wealth taxes. Some of these commission members were known for their hatred for Armenians, who were the children of the Armenian Genocide perpetrators, continuing the destruction of the remaining Armenians. In January 1943, thousands of houses, shops, flats, apartment buildings, factories, machinery and equipment changed hands from Armenians, Greeks and Jews to Turks and Turkish institutions. Turks grabbed about 67 percent of the real estate, and the Turkish state got about 30 percent. Most of the valuable real estate, designed and built by Armenian and Greek architects and owned by minorities on the main thoroughfare of Istiklal Caddesi, formerly Rue du Pera, changed ownership during this time.

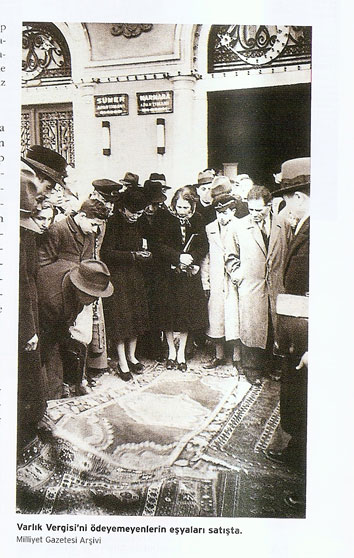

Toward the end of January 1943, auctions started to liquidate remaining assets of the minorities. The auctioned assets were not only house contents such as furniture and carpets. Among the heart-wrenching stories, a police officer ripped a rocking horse toy from the hands of a seven-year old Armenian girl, ignoring her cries and pleas. The wheelchair of a disabled Armenian old lady was removed after she was unceremoniously dumped on a mattress. In the dead of a cold winter, stoves and even blankets were removed from homes to be auctioned off. The dental instruments of an Armenian dentist, my mother’s family dentist, was sold based on the weight of the metal in the instruments.

We should emphasize that even though the justification for the Wealth Tax legislation was to collect money from the profiteering businessmen, it was applied not only to the wealthy, but even to the poorest people, if they were Armenians, Greeks or Jews. There were thousands of low income Armenians such as street vendors, fishermen, laborers, porters, fruit sellers, janitors and salaried workers, who made up 44 percent of people forced to pay these taxes. People without any real estate assets made up 43 percent of the assessed taxpayers. To give an example of the irrational assessment and unfairness of the legislation, a retired Jewish man was assessed 1,530 Turkish lira tax, but ended up losing his flat valued at 24,000 Turkish lira at an auction.

Between January and July 1943, 1,229 people, all non-Muslims, were sent to labor camps to Askale near Erzurum for non-payment of the Wealth Tax. Unable to withstand the harsh working conditions, lack of food and water, 21 people died. They would be placed in wooden boxes and buried in the fields or mountains without any funerals or clerics. One of the most unfortunate incidents is the fate of a Greek man who fell ill in the labor camp in Erzurum; he wrote a letter to his wife in Istanbul to sell the last piece of their family jewelry so that they can pay off their debt and he can return. The wife finally sells it, pays the debt to the tax office, sends the receipt proof to Erzurum for the release of her husband. Erzurum labor camp officials respond that her husband had passed away three days ago.

The Turkish government ended the Wealth Tax legislation in September 1943 after the New York Times and other foreign media started writing about it. Parliament decided not to demand payment from still uncollected taxes at the end of September 1943, and people were allowed to return from the labor camps. A total of 314 million Turkish lira was collected, mostly from the non-Muslim minorities. This sum was equivalent to 80 percent of the 1942 Turkish state budget of 394 million Turkish lira.

The Wealth Tax had absolutely no impact on reducing profiteering, wartime prices or helping the economy of the Turkish state. Its main impact was to legalize the plunder and robbery of the minorities and to transfer the minorities’ wealth to the Turks and the Turkish state. The minorities were ethnically cleansed by the Armenian and Pontic Greek Genocides during World War I, but the remnants were still a significant force in Istanbul economy and real estate. The Wealth Tax served the purpose of economically cleansing the minorities during World War II.

Thank you Raffi for writing about this little know (to many in the west) sad episode. It is a further

display of the racist and destructive intent that has driven Turkish governments since Abdul Hamid II.

It also shows how the Turkish government has used its authority to steal wealth from non-Turks to

artificially boost the financial foundation of Turks.