In November 2018, Armenia’s acting government released a draft law, “On Amendments to the Tax Law of the Republic of Armenia,” which will reportedly be considered by the new National Assembly in January-February 2019.

One of the most notable changes included in the act is the revision of the country’s income tax rates.

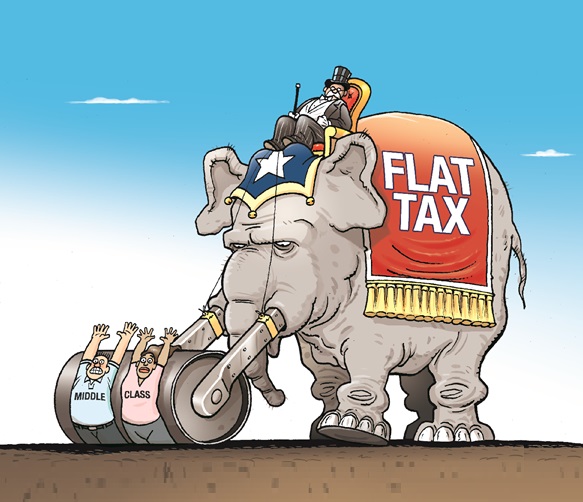

At present, income taxes are assessed in three tiers: 23 percent on the first 150,000 drams earned in a month; 28 percent on the portion of income above 150,000 drams, up to two million drams; and 36 percent on the balance of income over two million drams in a month. Under the proposed amendment, a flat tax of 23 percent will be assessed on all income; this rate will be lowered to 20 percent in 2023.

Thus, middle-income and high-income individuals will see five and 13 percentage-point cuts in their marginal tax rates in 2019 and eight and 16 percentage-point cuts, relative to today, in 2023, whereas low-income individuals will see no change in their tax rates initially, and a mere three percentage-point cut in the future.

The act would also reduce the tax on profits to 18 percent from 20 percent.

The proposal has already been criticized by some specialists. We add our political dissent to the draft law for the following reasons:

- The draft moves the burden of taxation from the wealthy minority to the impoverished majority. How will the government offset the revenue shortfalls brought about by the significant reduction of the profit tax rate, the middle-income tax rate, and especially the high-income tax rate? It will do so by raising other taxes. It has already been decided to increase use and excise taxes; increases in fees on certain government services and some other effective tax increases are also under consideration. In other words, the giveaway to the middle and especially wealthy class creates a new burden of expenses on the impoverished majority.

- Flattening taxes heightens income inequality and abets social injustice. Low-income individuals and families spend all or almost all their income on necessities. For high-income families, only a fraction of their income must go to bare necessities. Someone with a monthly income of 150,000 drams (or about $310) loses much more quality of life in paying 34,500 drams (23 percent) income tax than someone making, say, 2.4 million drams loses by paying 696,500 drams (at the current marginal rates). Any tax system, after all, is based on a redistribution principle. Whereas a progressive system aims to soften the impact of structural inequality and injustice, a flat tax exacerbates them.

- The draft will deepen social polarization in Armenia, which is already at unacceptable levels. Individuals with high incomes and profitable businesses will accumulate more than they could under current law. We will continue to have a minority that dominates economically and continues to get richer, accumulating disproportionate economic resources, including capital, compared to the majority of the people. Economic power is always political, which also makes these amendments politically unacceptable.

We do not deny the need for improvements in the tax system or for reviewing the existing tax rates and thresholds. Any change, however, must maintain the principle of progressive taxation. We find that the proposed amendments directly contradict the values of justice, equality, and comity.

We call on the members of the newly elected National Assembly and the country’s political leaders to step back from this process and develop a tax law that is based on progressive taxation, fairness, and the interests of the broad majority of the population.

—

Original statement in Armenian (includes list of signatories).

This translation was organized by the Zoravik Activist Collective and executed by Vincent Lima.

A flat tax is nothing but legalized tax evasion. The oligarch class can pay plenty. That’s why Alexandria Ocasio-Cortez wants to tax the rich at 70%.

I think that Armenian Weekly is quickly turning from just being “socialist” to being “rabidly marxist/communist”. Also, Alexandria Ocasio-Cortez is a moron for talking about taxing “the rich” at 70%. Why stop there? Let’s tax corporations at 80%, then complain why they put money offshore or start replacing employees with robots.

MIT economics professor Peter Diamond, who won an Economics Nobel prize and UC Berkley economics professor Emmanuel Saez, estimated that the optimal top tax rate should be 73 percent, while UC Berkley economics professor Christina Romer, who was the head of President Obama’s Council of Economic Advisers, estimated that the optimal top tax rate is more than 80 percent. These high, top tax rates existed in the US during rapid economic growth, 1940s, 1950s and 1960s. During the 1950s, when our economic was experiencing significant amount of economic growth, the top income tax rate was 90%. Clearly, Alexandria Ocasio-Cortez, the capable young congresswoman from New York, is fully in line with respectable academic economic research.